Annette Bui| Updated June 12, 2020 |

Mortgage Programs 101

Did you know that outside the normal 3-3.5% down payment requirement that the county or state has different down payment assistance programs that you may qualify for? While it may vary from state to state or sometimes even the county. Overall, the requirements entail that at least one borrower on the loan will be a first time home buyer. This means that as long as you have not owned or purchased a home in the last three years that you would qualify.

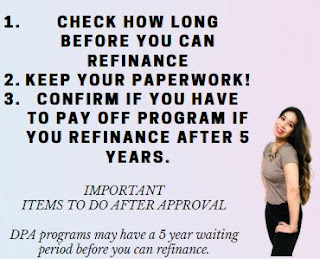

The down payment assistance depends largely on the income bracket that you are in along with a cap of sometimes up to 85% of your county limit. There is an online or in person course that you are required to attend and complete the certification along with the regular pre-approval procedures with your lender in order to qualify.

Comments

Post a Comment